Firo: The 120% Run-Up, The Recent Correction, and What The Data Suggests

FIRO's Double Take: Is This Rally Real, or Just a Case of Mistaken Identity?

Let’s talk about FIRO. No, not the sophisticated, forecast-informed reservoir operations framework that just got formally implemented at Lake Mendocino (New forecast-informed decision-making tool implemented at Coyote Valley Dam and Lake Mendocino) after years of rigorous testing—a genuine win for actual water management, by the way. We’re talking about FIRO, the privacy coin, which just pulled a nearly 120% surge out of thin air, only to hit the brakes right at a critical resistance point (FIRO price hits a snag after rising nearly 120%: here’s what to watch out for). It’s a classic crypto narrative, isn’t it? A sudden explosion, whispers of new utility, and then... the inevitable snag.

This isn’t just about a ticker symbol. It’s about how markets, particularly speculative ones, latch onto narratives. And frankly, the existence of two entirely distinct "FIROs" (one a genuinely impactful infrastructure project, the other a digital asset) creates a fascinating, if potentially misleading, backdrop. I’ve looked at hundreds of these charts, and the human tendency to conflate or misinterpret similar-sounding entities is a persistent variable. It makes you wonder how many casual investors, scrolling through headlines, might conflate the "FIRO" making headlines for dam operations with the "FIRO" they’re eyeing on their exchange app. It’s a methodological blind spot, a cognitive shortcut that can lead to some truly baffling capital allocation.

The Spark, The Surge, and the Skeptic's Glare

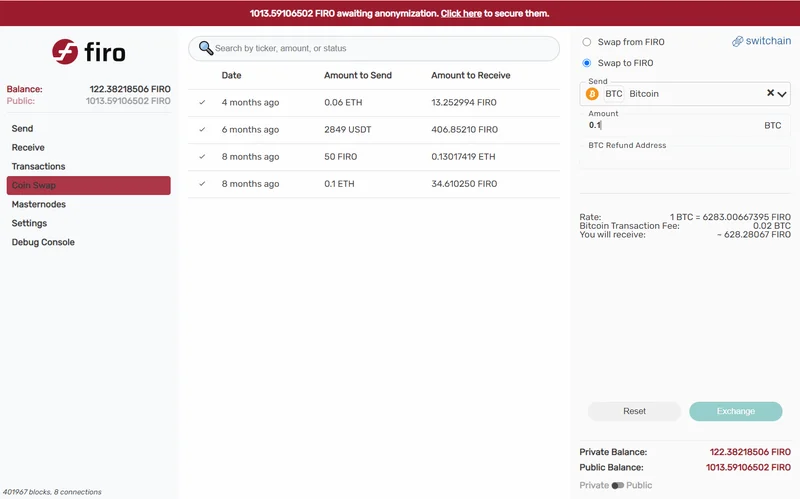

The recent momentum for the crypto FIRO, we're told, is rooted in its "Spark Assets" rollout. Launched early November, this feature supposedly allows developers to mint privacy-first tokens – think stablecoins, NFTs – all sharing a common anonymity pool. The pitch is compelling: every asset creation or private transaction requires FIRO tokens, theoretically converting Firo from just another privacy coin into a "privacy infrastructure layer." That’s a significant structural shift, if it sticks. Early metrics, we hear, show rising daily active addresses and higher transaction volumes. The market cap sits around $50.69 million, with a circulating supply of roughly 17.9 million coins.

But let’s get precise. The price soared by about 119.2% in the last two weeks, hitting a high of $3.11 before pulling back to around $2.82. That’s a roughly 9.3% retracement from its peak so far. The immediate question for any analyst worth their salt isn't just what happened, but why it happened, and how sustainable it is. Is this rally truly driven by the intrinsic value of Spark Assets, or is it simply riding the broader, often cyclical, "privacy coins hype" wave? Firo's history of pioneering zero-knowledge privacy and Dandelion++ on mainnet, coupled with its hybrid PoW + LLMQ masternode architecture, gives it technical credibility. Instant finality and chain security are genuinely rare in this niche. But technical prowess doesn't always translate directly to sustained market value, especially when the broader market is prone to narrative-driven swings.

The $3 Wall and What Comes Next

Technically, FIRO hit a brick wall right around $3. This isn't some arbitrary line in the sand; it's a level that has consistently capped rallies since mid-2022. The daily Relative Strength Index (RSI) is still in bullish territory, which suggests buyers are still around, but it's also oversold, flashing a warning sign. The MACD histogram remains positive, but a bearish divergence on the daily chart is a red flag, indicating that while prices pushed higher, the underlying momentum might be weakening. This is where profit-taking kicks in, testing lower support bands.

Traders are now watching the 38.2% Fibonacci retracement level, sitting at approximately $2.60. A dip below that could spell further decline, potentially toward the 50% Fibonacci retracement, or even the $1.47–$1.84 zone, according to some models. Conversely, a decisive weekly close above $3 could clear the path for a move towards $4.80. The chart, in its stark reality, is a battleground. You can almost hear the collective sigh of traders as the price nudged $3.11, only to retreat almost immediately—a digital echo of past rejections.

My analysis suggests that while the Spark Assets launch provides a legitimate narrative hook, the market’s reaction also reflects a broader appetite for privacy coins, an appetite that can be fickle. Regulatory pressure and exchange listings remain the perpetual Sword of Damocles hanging over these assets; past delistings have certainly dented liquidity, and those risks haven't vanished. There's also a mandatory software update (v0.14.15.0) before a hard fork on November 19, 2025. While it introduces useful features like Spark Name transfers and lower GPU VRAM requirements, any mandatory update introduces a point of potential friction or failure for the community. Ultimately, this isn't just about the code; it’s about user adoption. If Spark Assets can genuinely attract cross-chain activity through partners like Confidential Layer, then FIRO might build steady, utility-led demand. If not, if it's just another "infrastructure layer" in a crowded field without significant uptake, then we’re looking at deeper pullbacks. The numbers will tell the real story, as they always do.

The Illusion of Progress

Related Articles

California's FIRO Water Project: What It Is and Why You Shouldn't Believe the Hype

Better Late Than Never, I Guess So, gather ‘round, because I’ve just read a press release that’s bei...

Firo's Chennai Launch: Restaurant and Cocktails vs. Reservoir Management?

Generated Title: FIRO: California's Water Fix or Just Another Tech Bro Fantasy? Is Smarter Really Be...

Firo: What's Going On?

Will This Tech Bubble Burst? Here's What the Data Isn't Telling You. The market's been buzzing about...