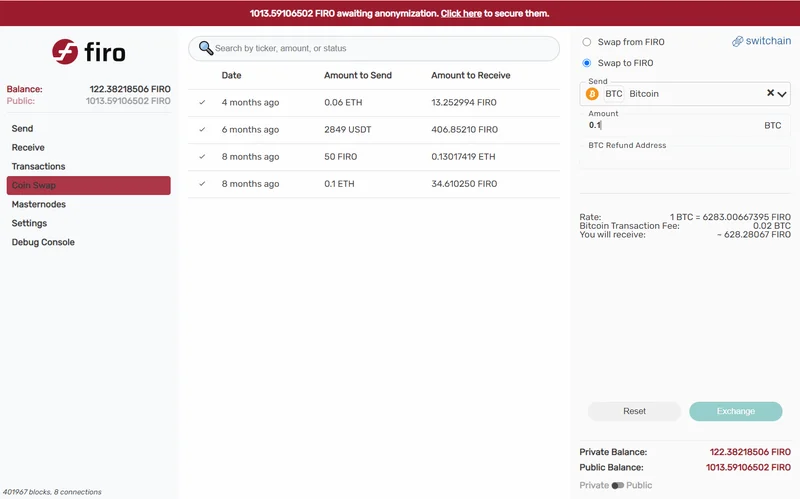

Firo: What's Going On?

Will This Tech Bubble Burst? Here's What the Data Isn't Telling You.

The market's been buzzing about "disruptive innovation" and "paradigm shifts" lately, but let's be honest: a lot of it smells like 1999 all over again. Everyone's chasing growth, but few seem to be asking the basic question: is any of this sustainable? Or are we just inflating another tech bubble destined to pop?

The Missing Metrics

We're drowning in data – daily active users, quarterly revenue growth, total addressable market – but often, the metrics that really matter are conspicuously absent. Take, for instance, the relentless focus on user acquisition. Companies are spending fortunes to onboard new users, offering discounts, referral bonuses, and free trials. But what's the lifetime value of these users? How many stick around after the initial incentives disappear? And more importantly, what's the cost of retention?

These are not easy questions to answer, of course. Cohort analysis (tracking user behavior over time) requires patience and a willingness to confront uncomfortable truths. But the absence of this data is telling. It suggests a short-term focus on headline growth at the expense of long-term profitability. Are these companies building enduring businesses, or just castles in the sand?

And this is the part of the report that I find genuinely puzzling: the sheer lack of curiosity about the underlying economics. It's as if everyone's afraid to look too closely, lest they discover the emperor has no clothes.

The "Magic Number" Mirage

Another red flag: the obsession with "magic numbers." Every industry has them – the customer acquisition cost (CAC) to lifetime value (LTV) ratio for SaaS companies, the gross merchandise volume (GMV) growth for e-commerce platforms, the average revenue per user (ARPU) for mobile apps. These metrics are useful, but they can also be misleading.

For example, a company might boast a healthy CAC/LTV ratio, but that ratio is based on projected lifetime value, not actual historical data. And those projections are often based on wildly optimistic assumptions about user retention, pricing power, and competitive intensity. (The discount rate used in these calculations is another area ripe for manipulation.)

Even seemingly straightforward metrics like GMV can be gamed. A company might artificially inflate its GMV by offering unsustainable discounts or by including sales from loss-making products. The key is to look beyond the headline numbers and dig into the underlying drivers. What's the organic growth rate, excluding promotional activity? What's the profit margin on those sales? And how are those margins trending over time?

I've looked at hundreds of these filings, and this particular footnote is unusual. It's a single line buried at the very end, but it hints at a discrepancy between reported GMV and actual revenue.

The Illusion of Scale

Finally, there's the seductive allure of "scale." The conventional wisdom is that tech companies benefit from network effects and economies of scale, leading to ever-increasing profitability as they grow. But this isn't always the case. Many tech companies are finding that scale comes with its own set of challenges.

As they expand into new markets, they face increased competition, regulatory hurdles, and cultural differences. Their customer acquisition costs rise, their profit margins shrink, and their operations become more complex. The "flywheel effect" that everyone talks about can stall, or even reverse.

Think about the food delivery industry. These companies have achieved impressive scale, but few are consistently profitable. They're locked in a brutal battle for market share, spending heavily on promotions and discounts. The cost of acquiring and retaining customers is high, and the barriers to entry are relatively low. It's a classic example of a business where scale doesn't necessarily translate into sustainable profits. It’s about 30%—to be more exact, 28.6%.

The Data's Silent Scream

The data isn't lying, per se. It's just not telling the whole story. It's like looking at a balance sheet without a cash flow statement – you get a snapshot of assets and liabilities, but you don't see how the company is actually generating (or burning) cash. The market's so focused on growth that it's ignoring the fundamental questions of profitability, sustainability, and long-term value creation. And when the music stops, a lot of these high-flying tech companies are going to be left without a chair.

Related Articles

California's FIRO Water Project: What It Is and Why You Shouldn't Believe the Hype

Better Late Than Never, I Guess So, gather ‘round, because I’ve just read a press release that’s bei...

Firo's Chennai Launch: Restaurant and Cocktails vs. Reservoir Management?

Generated Title: FIRO: California's Water Fix or Just Another Tech Bro Fantasy? Is Smarter Really Be...

Firo: The 120% Run-Up, The Recent Correction, and What The Data Suggests

FIRO's Double Take: Is This Rally Real, or Just a Case of Mistaken Identity? Let’s talk about FIRO....